nebraska property tax calculator

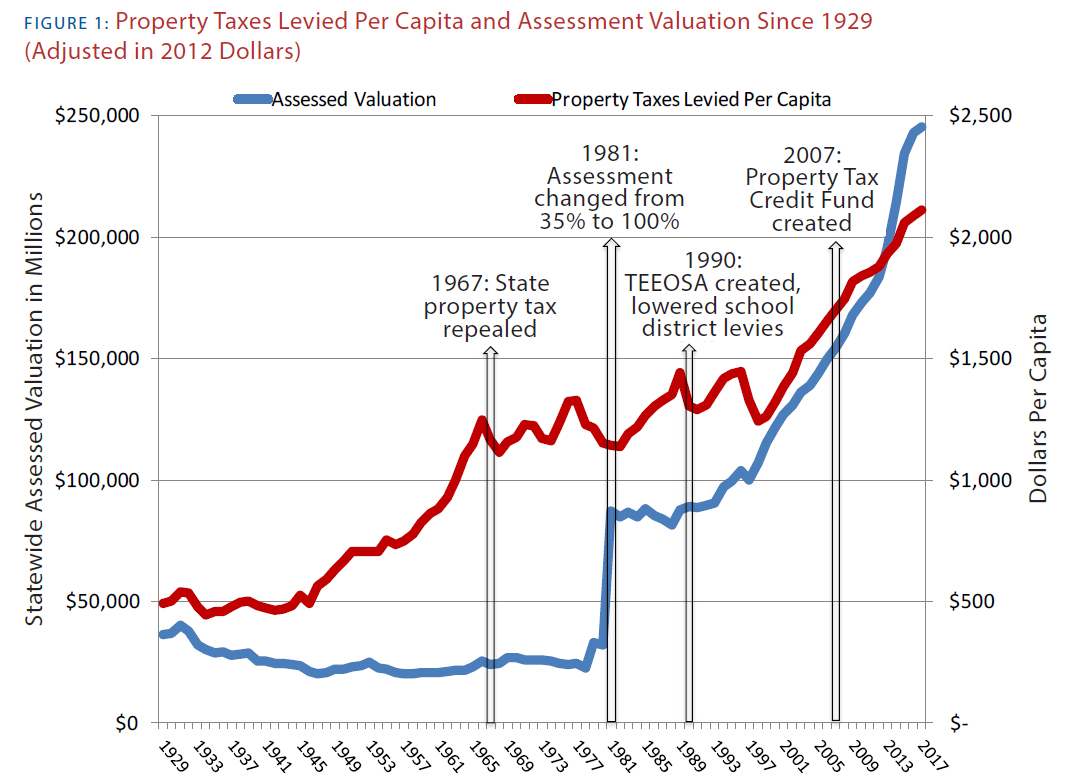

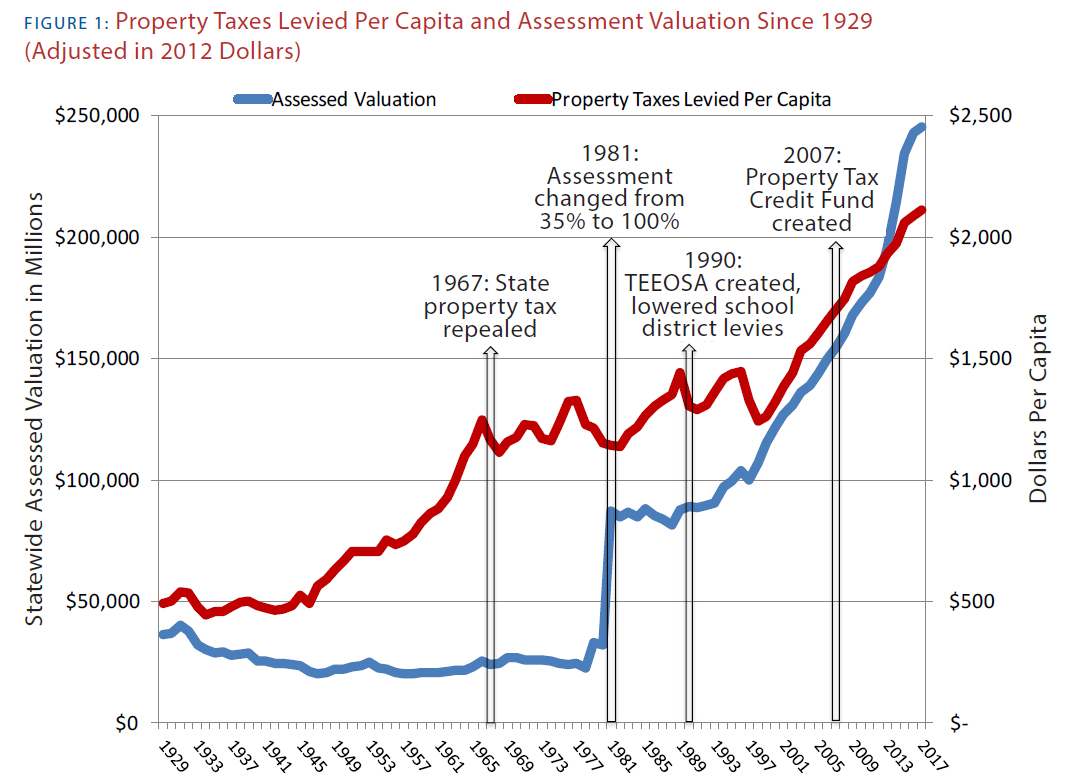

Nebraska launches online property tax credit calculator. Today property tax is the primary revenue raising tool for political subdivisions and in fiscal year 2018-2019 property tax revenue comprised approximately 374 percent of all state and local tax revenue collected in Nebraska.

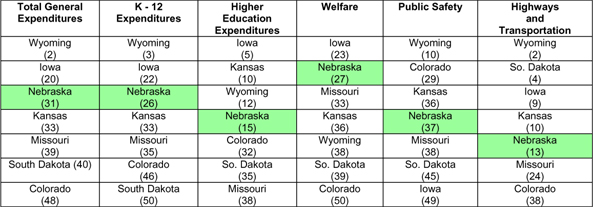

Taxes And Spending In Nebraska

To make their tax information available online.

. These monies were budgeted by all of the political entities at the end of the year to fund their budgets in 2021. The average effective tax rate in the county is 204 close to double the national average. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts.

If you make 70000 a year living in the region of Nebraska USA you will be taxed 11756. This tax information is being made available for viewing and for payments via credit card. F_ptcpdf nebraskagovCalculate the refundable tax credit by multiplying the total allowable dollar amount of property taxes paid by 0253 and enter the amount on line 1 of Form PTC.

Enter the property tax year for which the Nebraska school district property taxes were levied. A convenience fee of 235 100 minimum is included on all payments. The NE Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in NES.

The Registration Fees are assessed. Most taxpayers pay their property tax in the year after the taxes were levied. Nebraska is ranked number seventeen out of the fifty states in order of the average amount of property taxes collected.

See example 1 above. Overview of Nebraska Taxes. Welcome to Nebraska Taxes Online.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Sarpy County. Yes look for Property Owned by an Individual Tax Credit in the Nebraska tax section. Nebraska State Tax Calculator Tax Calculator The Nebraska tax calculator is updated for the 202223 tax year.

The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the NE property tax calculator. Officials announced a new online property tax tool to help Nebraskans as they work on their tax preparations this year. The single largest recipient of property tax dollars.

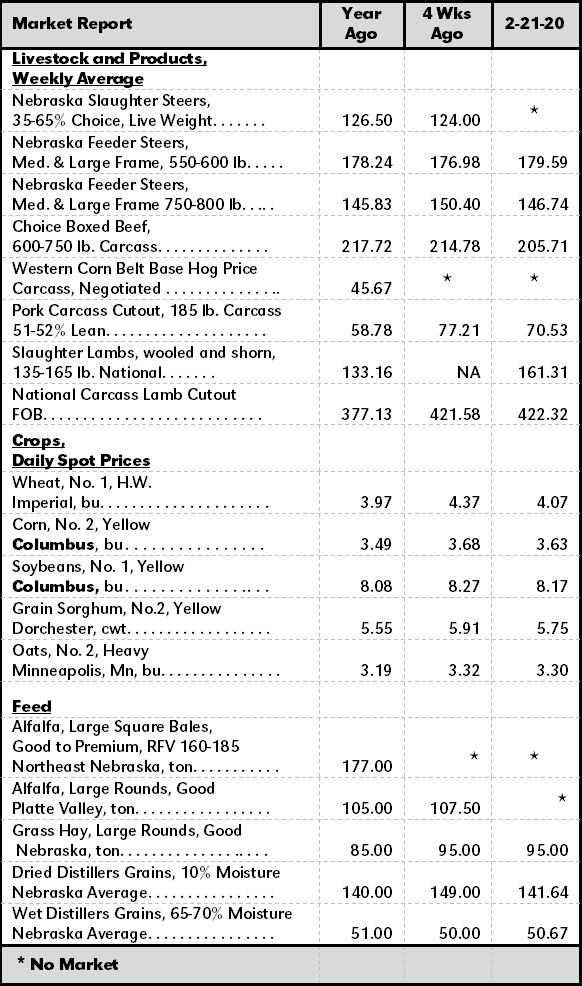

Registration fee for farm plated truck and truck tractors is based upon the gross vehicle. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. Nebraska Property Tax Calculator to calculate the property tax for your home or investment asset.

The Nebraska income tax calculator is designed to provide a salary. Property tax is calculated based on your home value and the property tax rate. Real estate taxes levied in arrears per Nebraska State Statute.

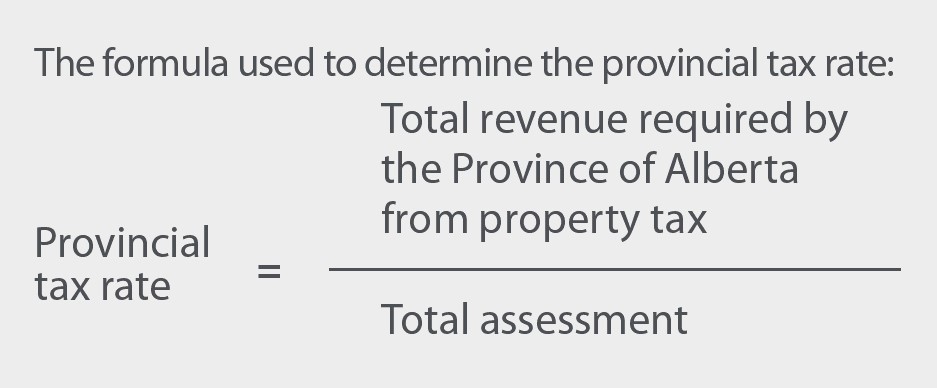

Average for states with income taxes. Property tax Assessed Taxable Property x Rate Credits. The median property tax paid in Lancaster County is 3061 while the state median is just 2787.

WOWT By Gina. After a few seconds you will be provided with a full breakdown of the tax you are paying. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Nebraska Income Tax Calculator 2021. Property tax calculation can be summarized by. The Nebraska Department of Revenue DOR has created a GovDelivery subscription category called Nebraska Income Tax Credit for School District Taxes Paid Nebraska Property Tax Incentive Act Click here to learn more about this free subscription service as well as sign up for automatic emails when DOR updates information about this program.

Counties in Nebraska collect an average of 176 of a propertys assesed fair market value as property tax per year. Our Nebraska Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Nebraska and across the entire United States. The top rate of 684 is about in line with the US.

The Nebraska Property Tax Incentive Act provides a refundable income tax credit credit or credit against franchise tax imposed on financial institutions for any taxpayer who pays school district property taxes. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase. Enter the dollar amount of taxes paid on each parcel on Form PTCNebraska Property Tax Incentive Act Credit Computation.

Nebraska Property Tax Incentive Act Credit 182021 The NebFile for Individuals e-file system is closed for annual maintenance to prepare the system for the upcoming 2021 filing season. The counties on our site have made an agreement with MIPS Inc. The median property tax on a 15860000 house is 279136 in Nebraska The median property tax on a 15860000 house is 166530 in the United States Remember.

The first half of the 2020 taxes becomes delinquent April 1 2021 and the second half August 1 2021. Nebraska has a progressive income tax system with four brackets that vary based on income level and filing status. Sarpy County is part of the Omaha metropolitan area and has the highest property tax rates of any Nebraska county.

The median property tax in Nebraska is 216400 per year for a home worth the median value of 12330000. To use our Nebraska Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Enter Property Value Choose the Property.

Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle. 1500 - Registration fee for passenger and leased vehicles. If more than one year of property tax was paid in the income tax year a separate entry must be made for each property tax year.

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Nebraska Sales Tax Small Business Guide Truic

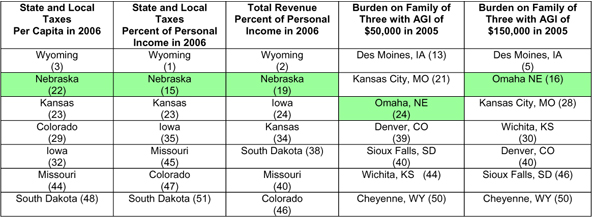

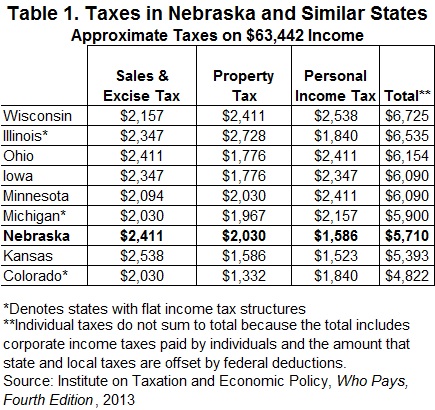

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Transfer Tax Calculator 2022 For All 50 States

Taxes And Spending In Nebraska

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

50 Million In Nebraska Property Tax Relief Goes Unclaimed Total May Rise

Nebraska Property Tax Calculator Smartasset

2020 Nebraska Property Tax Issues Agricultural Economics

Past Policy Maps Legislative Research Office

Nebraska Property Tax Calculator Smartasset

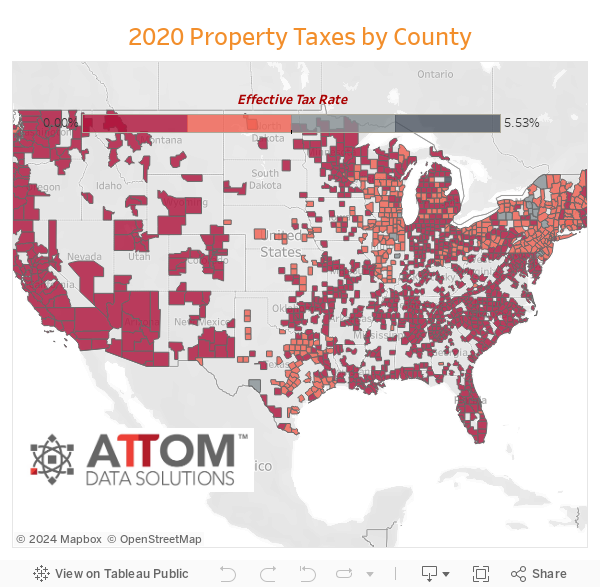

Property Tax Map Tax Foundation

Nebraska Property Tax Calculator Smartasset

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Property Tax Tax Rate And Bill Calculation

States With The Highest And Lowest Property Taxes Property Tax High Low States

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com